Friends who have studied history must all understand that since the founding of the People's Republic of China, the Western countries imposed a technical blockade on China. After domestic researchers have worked hard to study hard, they have finally achieved today's achievements. However, this does not mean that the technical blockade has stopped. The U.S. government has recently pointed the finger at China’s semiconductor industry to see if China can once again break through the technological blockade of Western countries.

Uncle Sam can be so scared that the domestic semiconductor industry is undoubtedly has made rapid progress, the following specific look at the recent domestic major actions:

Building factories in China to seize the mainland market

In 2015, China’s share in the global semiconductor consumer market was 58.5%, and its market in the global semiconductor industry also increased to 16.2%. In the past decade, the compound annual growth rate of China's semiconductor industry was as high as 18.7%, while the compound annual growth rate of semiconductor consumption was also 14.3%. In contrast, the global semiconductor market has a compound annual growth rate of only 4.0%.

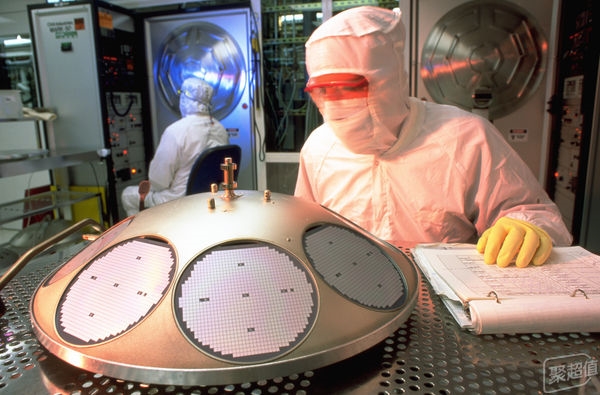

With strong global growth, there is no doubt that China has unlimited business opportunities. Sensitive manufacturers will certainly not miss this opportunity and have established their own wafer factories in China, including international giants Intel and Samsung to Taiwan. UMC, Powerchip and Taiwan Semiconductor Manufacturing Co., Ltd., as well as semiconductor manufacturers such as SMIC and Changjiang Storage in China, according to data from the International Semiconductor Association (SEMI), have at least 19 new fabs in 2016 and 2017, of which up to 10 Blocks will all set foot in China. Under such an upsurge of building factories, it is only a matter of time before the two industries are manufactured, sealed, and tested.

"Chinese core" emerges

As early as 13 years, the total amount of chip imports has exceeded the total amount of crude oil imports. The country has realized the importance of this issue and decided to vigorously develop the semiconductor industry. This decision can be very succinctly called “big fund†by Guokai Finance and China Tobacco. Fifteen companies such as China Mobile and China Mobile invested 138.7 billion yuan in the first phase. Under the so-called rewards, there must be Yongfu. Under the strong support of national and local funds, Chinese chip companies have made great efforts.

The most notable of these was the Ziguang Group, which took 13 years of acquisition of Spreadtrum Communications and spent 1.78 billion U.S. dollars; 14 years of acquisition of Rui Dike and spent 910 million U.S. dollars; 15 years of acquisition of Xi'an Huaxin; acquisition of Tong Guoxin, The latter had a market capitalization of US$3.1 billion; the acquisition of 51% of Xinhua Santong’s shares of Hewlett-Packard cost US$2.5 billion; money does not seem to be a problem for Ziguang. Ziguang’s goal is to support the local semiconductor industry at all costs.

In addition to the National Fund, there are some local small funds, Wuhan Xinxin Project, which also benefited from the full support of Wuhan City, and immediately obtained 24 billion U.S. dollars of local government investment. The new Wuhan Xinxin Base of Yangtze River Storage will be divided into three phases with a total planning area of ​​approximately 1 million square meters. The first phase will be started in August and is expected to be completed by 2018. The monthly production capacity will be approximately 200,000 pieces, and the official target will be to base by 2020. The total production capacity reaches 300,000 tablets/month, and in 2030 it reaches 1 million tablets/month. The technology is obtained through the U.S. Freeway and is completely behind Samsung's three generations. Regardless of the technology, at least people have their own technology. There is no doubt that the project funds are certainly very much taken care of (violet also has investment).

Also benefited from large funds and small funds, Fujian Jinhua also received a lot of financial support, and also signed a technical cooperation agreement with UMC, from Jinhua to pay, UMC to produce technical cooperation with niche-based DRAM. The coalition government's enterprises also acquired Zhaoyi Innovation, a US-based ISSI, to build a 12-inch wafer production plant with monthly production capacity of 125,000 wafers in Hefei.

IC manufacturing and design dual force

With the support of major funds, the two largest wafer foundry companies in China, SMIC and Huali Micro, began to expand their production capacity. On October 13, 2016, SMIC invests nearly 100 billion yuan to start a new 12-inch production line in Shanghai, with a manufacturing process of 14 nm and below, and a monthly capacity of 70,000 wafers. In addition, SMIC invests and builds a monthly production capacity in Shenzhen. The 40,000-inch 12-inch production line invested in the expansion of the original 8-inch plant in Tianjin from 45,000/month to 150,000/month. Huali Micro announced the launch of the second-phase 12-inch high-tech production line construction project with a total investment of 38.7 billion yuan and a monthly production capacity of 40,000.

Beijing Jun is announcing the acquisition of 100% equity of Beijing Haowei, 100% equity of Xinyuan, and 40.4343% of Sibico, totaling 12.6 billion yuan. Through the acquisition of Beijing Howeway and Sibike, Beijing Jonde made up for the shortcomings of its integrated circuit industry chain R&D and design capabilities, ranking among the top three in the global image sensor market.

Of course, in addition to mergers and acquisitions, the country also attaches great importance to the development of the IC design industry, and the investment ratio has increased from 45% to 60%. Under the favorable conditions of such policies and funds, more and more companies have invested in integrated circuit design. The good semiconductor atmosphere has also attracted more overseas students to return to China to start their own businesses. The number of IC design companies has doubled from 1,300 in the previous year to 1,300 in 16 years. In fact, according to statistics released by the China Semiconductor Association, China's IC design output value of Q3 has surpassed Taiwan in 16 years, totaling 68.55 billion yuan in the first half of the year, an increase of 24.6% year-on-year, surpassing Taiwan, which is a major blow to Taiwan's IC design industry.

These are just some of the more prominent incidents. In the past two years, the domestic semiconductor industry has really advanced by leaps and bounds. No wonder Uncle Sam couldn't sit still. After taking a series of shots and pressure, here's what Sam has done:

Uncle Sam's attitude can be attributed to a report received by former President Barack Obama before his departure: Historically, the global semiconductor market has never been a completely competitive market. . . . . We believe that China's competitive approach is to distort the market. They have robbed the U.S. market share by sabotaging innovation and put the United States at risk of homeland security. . Therefore, in the process of innovation, the U.S. government should also try its best to prevent China's destruction and influence.

In February 2016, Fairchild Corporation of the United States rejected two Chinese buyers, China Resources Microelectronics and China Venture Capital, for an acquisition offer of US$2.6 billion, and instead chose ON Semiconductor (Onmux), which has a lower bid than Chinese companies. The reason given by the semiconductor company is that it is feared that the US regulatory authorities will stop the transaction and do not know whether Fairchild has any feeling of being confined by pigs.

In February of the same year, Ziguang Co., Ltd., a subsidiary of the Ziguang Group, announced that it had decided to terminate its purchase of western data for US veteran storage companies for US$3.775 billion. This was also because the US Overseas Investment Committee CFIUS intervened.

On March 7, 2016, the website of the US Department of Commerce announced that China’s telecom equipment supplier “ZTE†has been listed as “not in conformity with US national security or foreign policy interests†because of alleged violations of U.S. export control laws against Iran. The “entity list†enforces sanctions that limit exports.

In December 2016, Obama took a big vote before leaving office. China Fujian Hongxin Investment Fund's purchase of German semiconductor manufacturer Aixtron was banned in the United States. The ban is based on the assessment of the United States CFIUS, the United States is worried that Aisiqiang can be used for military purposes, gallium nitride (GaN) materials are mastered by China.

These are the obstructions of China during the Obama era, not to mention the series of crackdowns on trade with China after Trump took office. The U.S. practice is as it has always been. The industry standards are set by me. Everything should follow me. As for what happens later to the people, they are distorting the market, maliciously competing, and fighting and sanctioning. Given the hardline attitude of the United States, will the situation resemble that of the semiconductor industry of Japan in the 1980s.

China's semiconductor rises full of thorns

Just as the Ministry of Industry and Information Technology responded a few days ago, the United States does not need to be too nervous about the layout of the Chinese semiconductor industry. China does not want to have a conflict with the United States. After all, many relevant plans are still in the initial stages of formulation.

Whether or not a project can succeed depends largely on funds and technology. Funding is certainly not a problem for our country's system. Concentrating on the strengths of major events has significant advantages. However, the technical aspect is a big problem. At present, the White House has already realized the ambition of the Chinese government and greatly increased its vigilance and auditing. The window to acquire advanced technology and companies to develop their own semiconductor industries has been closed.

Since the acquisition can not be, how much is the gap between the current technology and foreign countries? Conservatively speaking, at least 2 generations behind foreign countries, the above mentioned that China's major fund investment in Yangtze River storage, Fujian Jinhua, Hefei Changxin, etc. Although the construction of the factory is in full swing, the technology still lags behind and does not pull in the gap.

When it comes to technology, the issue of talent is indispensable. The development of domestic semiconductors is making rapid progress. The treatment given by the industry is also quite generous. There are a large number of senior technicians dug in both hardware and software. There are many heavyweights, such as former Chief Operating Officer of Taiwan Semiconductor Manufacturing Co., Ltd., Jiang Shangyi, as SMIC. Independent director. However, the arrival of personnel does not mean that it will be able to bring about smooth production. Jiang Shangyi’s terms of service will not help SMIC’s existing employees in the company, nor will it recommend that SMIC do anything unfavorable to TSMC. The arrival of other technical personnel will also face the risk of a lawsuit. In 2010, TSMC claimed that SMIC had employed TSMC with more than 100 employees and asked them to provide relevant trade secrets of TSMC. The final result was that SMIC paid TSMC 175 million U.S. dollars for settlement.

Freezing is not a day's cold. The country is currently talking about semiconductor hurricane sudden progress, but it still stays in the consumer field. The real manufacturing industry is still just an entry level. The gap with foreign countries is still huge. Although the country's strong support has advanced a few times, Acquisitions have narrowed many gaps, but the situation remains grim. Even if the country has the money to invest hundreds of billions of dollars in this project, at first glance the local tyrants do not really need money, but the success of an industry depends on whether there is a mature industrial chain, from the basic equipment to the training of talents. The amount of money that can be allocated to the link is not much, let alone foreign investment for decades. So the investment of thousands of dollars is really not much, not to mention the lack of strategic deployment and planning at the national level over the years. It is very late for China Semiconductor to start.

Although it is a bit frustrating, but this kind of thing is really in jeopardy. The gap in decades is not catching up in a year or two. What's more important is that the country has already positioned core technology for semiconductor development as a national strategy. Progress at the national level is the most suitable development strategy for our country. Just as a little bit of trouble in the old United States can be upgraded to threaten national security, there must be such awareness in the country to develop its own semiconductors. The general sentence: The future is bright, and the road is tortuous.

AC power supply is a kind of power supply that converts the input mains or DC input into a pure sine wave output after AC-DC-AC or DC-AC conversion. The ideal AC power supply is characterized by stable frequency, stable voltage, zero internal resistance and pure sine wave output voltage wave (without distortion). Mainly used for power grid simulation tests conducted by various electrical appliance manufacturers on electrical appliances according to the voltage/frequency requirements of different countries, various AC motors, AC transformers, aircraft & mechanical equipment and other electronic devices that require pure, regulated and frequency-stabilized output.

Our AC power supply mainly includes three types

1. AC Power Supplies converting the input mains AC by AC-DC-AC, output voltage and frequency are stable and adjustable with pure sine wave output waveform, so called: Variable Frequency AC Power Supplies.

2. AC Power Supplies converting the DC output of the battery and other DC equipment by DC-AC, giving an AC sinusoidal output with stable output voltage and frequency. so called: Inversion AC Power Supplies.

3. AC Power Supplies converting the input mains AC by AC-DC-AC, giving a variable voltage AC output at constant 400Hz output frequency ultra-high output frequency stability. so called: Intermediate Frequency AC Power Supplies.

4. According to the difference in the number of output phases, the AC Power Supplies can be divided into single-phase output AC power supplies and three-phase output AC power supplies.

Different from Variac and AC voltage regulators, our AC power supplies support the setting of output voltage and frequency and has superior high precision, high stability, and high efficiency stable frequency AC output, not only for AC power conversion but also for AC high precision test purpose.

Through the friendly operation panel, you can read the output data such as output voltage, output current, output power, power factor, etc., providing accurate data records for your test, and can add RS485 interfaces as standard, following the MODBUS-RTU international communication protocol, which can realize remote control and operating status monitoring of the power supplies.

Our AC Power Supplies have comprehensive protection functions, such as: over voltage, over current, over temperature and short circuit protections, which can protect the AC power supplies and DUT from damages.

AC Power Sources, AC Sources, AC - AC Power Supplies, DC - AC Power Supplies, AC Switching Power Supplies

Yangzhou IdealTek Electronics Co., Ltd. , https://www.idealtekpower.com